PayWow has designed a payroll solution with fleet owners like you in mind. We understand the difficulties you face in handling payroll and compliance and put your needs in one easy-to-use system.

You’ve Got Payroll, We’ve Got Solutions

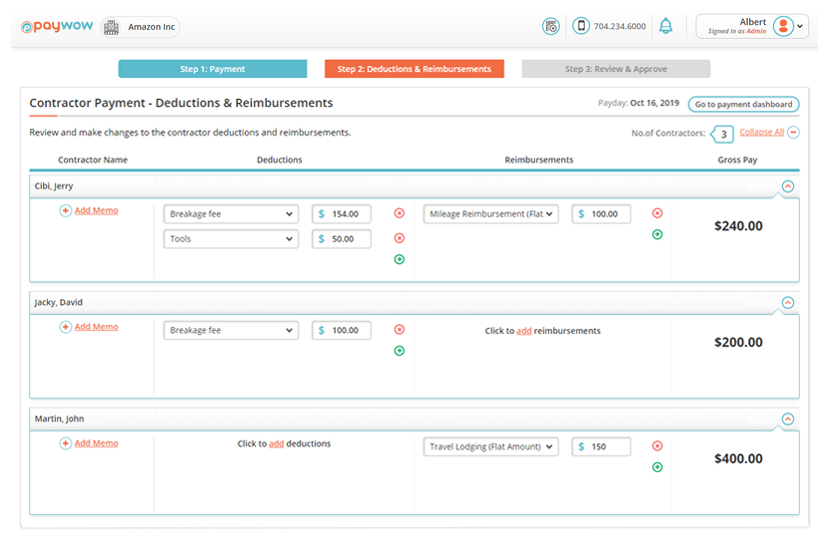

Manage Driver and Dispatch Settlements

Have contractors, commissioned or salaried employees? PayWow has you covered. PayWow allows you to pay drivers, dispatchers, handle deductions and reimbursements in a few, simple clicks.

Make payments for individual contractors per mile (loaded or empty), by load percentages, hourly or fixed rates via direct deposit or check. Handle per diem or detention payments, hauling charges, and any applicable fuel charges quickly and easily through PayWow.